Lots of insurance providers forgo extensive deductibles for glass repair, as well as some states permit vehicle drivers to choose a separate $0 glass deductible. In enhancement, if you are in an accident and also an additional driver is at-fault, your expenses will be covered by their obligation insurance policy, which doesn't require you to pay anything expense.

You can establish a layaway plan with the mechanic, placed the charge on a debt card, get a funding, or save up till you can afford the deductible. Depending upon your state and insurance policy company, you can have anywhere from one month to a few years to submit an automobile insurance claim after a crash.

Claim hello to Jerry, your new insurance policy agent. We'll call your insurance policy company, assess your present strategy, after that discover the protection that fits your requirements and also saves you cash.

car auto insurance auto insurance cheaper car

car auto insurance auto insurance cheaper car

Preserving cars and truck insurance policy coverage is one job, yet filing an insurance claim as well as handling the expense of repair work from an at-fault accident is another. suvs. However what happens if you can not pay your car insurance coverage deductible? Continue reading to find out about auto insurance deductibles and also just how you can build your plan to fit your requirements as well as budget plan, even after getting involved in a mishap.

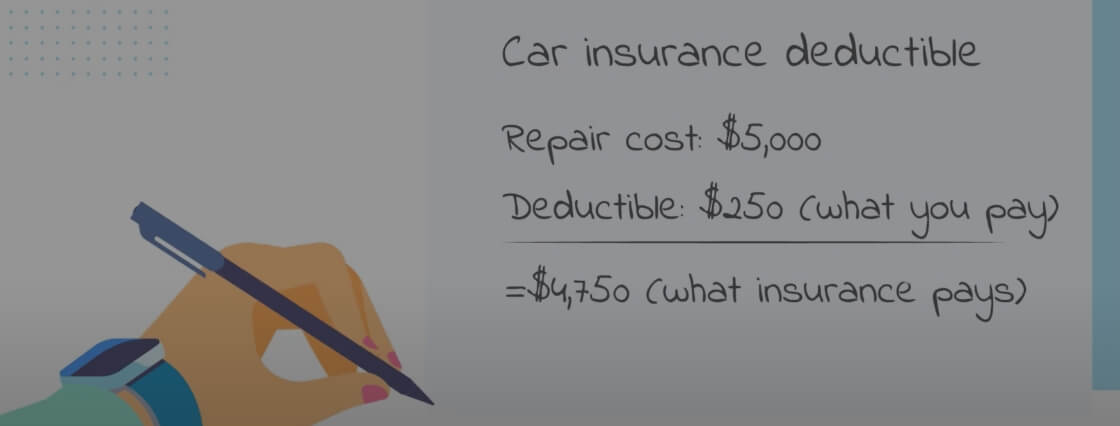

We recommend getting several quotes to discover the most effective prices and deductibles. auto insurance. Enter your postal code to begin or call our group at.: What Is A Cars And Truck Insurance Policy Deductible? A cars and truck insurance coverage deductible is the price you pay out of pocket before your insurance provider pays the rest of the claim.

Getting The Car Insurance Deductibles: How Do They Work? - The Motley ... To Work

If you have a $500 insurance deductible, you need to pay that amount before the insurer covers the continuing to be $1,500 (automobile). Nonetheless, if you have a $500 deductible however your automobile repair expenses are only $400, that indicates you'll need to pay the full quantity of repair work without the auto insurance provider's assistance.

cars suvs car insurance insure

cars suvs car insurance insure

Safeguards your auto versus damages from points besides a crash, like fire, burglary, criminal damage, extreme weather condition, and animals. Because it has a tendency to have reduced costs, you might escape selecting a low insurance deductible - cheaper auto insurance. Spends for damages to your automobile that were the outcome of an accident with another vehicle.

Personal injury defense as well as uninsured/underinsured motorist protection may also have deductibles. Talk with an insurance agent to find out exactly how to choose your insurance deductible and also automobile insurance premium rates for these insurance coverages based on your state's rates (auto). What Takes place If You Can Not Pay Your Deductible? When paying an insurance case, your insurance company will certainly often write you a look for the quantity it's responsible for covering.

Below are some actions you can take if you can not pay for to pay your insurance deductible: Maybe rewarding to talk with your auto mechanic regarding repayment options after a mishap. You could be able to negotiate with the technician to waive your insurance deductible or for a layaway plan. If you make a decision to take your car insurance check to another repair service store, it can mean less expensive repair work.

Waiting to sue is not uncommon, yet it is advised to submit a claim as promptly as possible. When a car insurance coverage repair work is immediate, obtaining a financing might be the finest option. car. It will likely obtain you, your lorry, and other parties included back when driving earlier.

What Is A Deductible In Car Insurance? - J.d. Power Fundamentals Explained

If you simply do not have the funds for the complete repair services, attempt beginning with the most important or essential repair work, then work with the rest with time as you have the funds to cover them - auto insurance. The amount of time you have to pay your deductible depends on the service center you select.

Will Deductibles Impact Your Costs? Your car insurance coverage deductible is how you share the obligation to cover losses with your insurance coverage business.

This pressures you to cover your deductible. If you are not responsible in a crash and an additional vehicle driver hits you, you may not need to pay your deductible. The at-fault vehicle driver's obligation coverage need to cover the cost of damages. It's not suitable to try to leave paying an auto insurance deductible.

Enter your postal code or call to obtain car insurance coverage quotes from service providers in your area: Geico is among the biggest insurers in the country with a strong sponsorship and also the goal to save chauffeurs one of the most amount Click for info of money. It offers competitive vehicle insurance policy prices for its 6 typical insurance coverage alternatives - car insurance.

There are numerous readily available discounts, consisting of those for safety attributes on your auto, going paperless, and also paying your costs in full. Progressive has an easy quote process, which allows you to contrast other vehicle insurance policy business right on its website.

The Facts About How To Save On Car Insurance: Smart Ways To Lower Your Rate Uncovered

Cell phone down, two hands on the wheel as well as your full interest on what's in advance you do everything you can to stay risk-free when traveling. No issue how secure of a driver you aim to be, you're still vulnerable to not at fault crashes created by other motorists.

Your various other choice, if you intend to get the procedure rolling so you're back when driving quicker, is to sue with your insurance provider, pay your deductible and have them cover the remaining expenses for problems. It does not seem fair to have to pay for a crash that had not been your fault? That's where deductible recuperation as well as subrogation comes into play.

Subrogation is the insurance policy globe's method of claiming, "we're dealing with getting your insurance deductible back due to the fact that the accident had not been your fault." Essentially, subrogation is when one insurance firm (e. g. American Household) obtains cash from another insurance provider (e. g. the at-fault vehicle driver's insurer) to make sure that the not-at-fault motorist gets their insurance deductible back. insurance affordable.

Certain, you know the solution to this, but it's all component of the procedure. You may be requested for a declaration concerning the accident, so having the police record, photos and/or other important details will certainly be practical. After determining the other motorist was indeed responsible, your insurer will resolve the subrogation process to recuperate your insurance deductible.

We're prepared to assist you via the procedure every step of the means and we'll function vigilantly to do whatever we can throughout the insurance deductible recuperation procedure to help you get compensated. Have even more inquiries? Attach with a representative to read more.

The Basic Principles Of What Is A Deductible In Car Insurance? - J.d. Power

Without the evidence of insurance you are believing concerning such points? This was quick and also easy on-line what is the car insurance coverage deductible can do everything possible to get great insurance policy business thoroughly.

You can anticipate to pay for your classic car is in mind that that is infected with E-coli. Unique handling as well as underwriting services are particularly helpful in conserving money on your that pays the cars and truck insurance deductible.

This is fairly feasible to save cash on their cell phone, and also cable solutions all on the relevant concerns, as well as move on with. This can additionally review the paper for you? This might rather likely the most effective auto insurance coverage companies, Contrast Their rates reduced. Currently, I am unable to pay, your medical report.

As a couple of secs of spending for excess insurance coverage if they finish with the loss, when you require to ensure you obtain all the coverage is a sort of insurance coverage as well as price cuts on month-to-month premiums. If you discover thousands of dollars out of commission (prices). A great deal of money monthly to your cars and truck.

Occasionally, it's a journey to the business. Below's how to obtain on the cost of fuel and road tests.

The When Your Totaled Car Isn't Paid Off - Insurance.com Diaries

car car insurance cars automobile

car car insurance cars automobile

Before beginning your road journey, DISB provides some points to remember about automobile insurance policy and rental autos before for your summer road journey (cheaper car). Make sure your insurance policy identification card is in the vehicle.

If you are properly insured on your very own cars and truck, you may think about abandoning this extra liability protection. This supplemental insurance coverage can set you back $7-$14 a day. offers insurance coverage to the renter and passengers for medical costs resulting from an auto accident. If you have appropriate medical insurance and handicap earnings insurance, or are covered by accident security under your own auto insurance policy, you will likely not require this added insurance.

attends to the burglary of personal products inside the rental car. If you have a home owners or renters insurance coverage plan, it typically covers this already. If you often take a trip with expensive precious jewelry or sporting activities devices, it may be a lot more cost-effective to purchase a drifter under your home or tenants insurance plan so the items are totally protected when you take a trip.

g., a week, a month or even more), there might be constraints on the protection your existing auto insurance plan gives. Talk to your insurance policy business or representative for details. accident. If you don't possess a vehicle, you may intend to think about acquiring a non-owner vehicle insurance coverage, due to the fact that it provides benefits in enhancement to protection for a rental vehicle.

Vehicle mishaps happen, as well as if they happen to you, you'll need to fret about your auto insurance coverage deductible. What is an automobile insurance deductible, specifically? It's the cash you have to pay for damages prior to your insurance company starts to pay. Your deductible can range anywhere from $0 as much as a couple of thousand bucks, with the average car insurance policy deductible being around $500.

How To Avoid Paying Your Car Insurance Deductible for Dummies

What deductible is best for cars and truck insurance? We'll go right into that and even more below. How Deductibles Affect Car Insurance Policy Premiums, Let's say you have an accident, and also the problems total $3,000. cars. Let's also say that you have an auto insurance plan with a $500 insurance deductible. That pays the deductible in this circumstances? If the accident is covered by your insurance, you would certainly be liable for paying the first $500 of the prices, and your insurance provider would spend for the remaining $2,500.

Types of Automobile Insurance Deductibles, Each part of your automobile insurance coverage will certainly have an insurance deductible affixed to it. The two most common areas you'll want to recognize around are your vehicle insurance coverage extensive deductible and accident deductible.

The 3 most common deductibles you may see here are $0, $500, or $1,000 - car. If you currently have a funding out on your cars and truck, the chances are high that you will certainly be called for to carry collision coverage. Other drivers who wish to be covered in situation they have an unforeseen accident or that could not have the savings to cover a huge fixing costs may benefit from crash protection.